To speed up the process, you require a plan and also the help of qualified consultants. Make use of these tips to learn how to offer your organization quickly at the highest possible rate.

1. REVIEW OF ACCOUNTING DOCUMENTS

Your accountancy records record your firm’s record of success and also disclose your company’s prospective value to a purchaser. To discover how to market a company quick, create a collection of bookkeeping documents that consists of these components:

Accurate, updated documents that comply with bookkeeping standards: If your documents are exact as well as current, a customer can assess your financials in less time. It’s additionally vital that your records adhere to accounting standards to ensure that your economic statements are equivalent with various other companies.

Yearly organization planning, budgeting, as well as projecting: Reliable supervisors create an annual company plan- and a formal budget- prior to the beginning of every year. Your budget ought to include a sales forecast, allocated prices, and planned list prices. Implementing these plans every year reveals a prospective buyer that your company is well taken care of, which enhances its worth.

Cash flow projecting as well as management: watch out TYLER TYSDAL Twitter For lots of companies, cash money administration is just as crucial as earnings, as well as you require a formal process for handling cash flow. As you produce your yearly budget for sales as well as expenses, you can develop a cash flow projection.

Industry criteria and also evaluation: A buyer will certainly contrast several aspects of your company’s performance to industry criteria, and you need to examine your firm utilizing the very same benchmarks. If services in your sector normally generate a 30% gross profit, as an example, you require to create outcomes that are at or over the 30% criteria.

If you have exact and also current data for each of these subjects, you’ll know exactly how to market a small company promptly.

2. ORGANIZATION PROCEDURES DOCUMENTED

The largest worth in your organization may be how well you operate your firm every day. If you make smart choices concerning routine tasks, such as payment, gratification, as well as manufacturing, you can produce an useful service that surpasses your rivals. The documentation of your organization operations is an important property to a customer.

Procedures hands-on: This hands-on papers each routine job you perform, who completes the task, and also exactly how frequently. Keeping a procedures handbook eliminates complication about doing a particular task, and is a great training tool for your team.

Organization chart: The graph allows a customer to recognize how your company is handled.

Present supplier and customer agreements, Tyler Tysdal employment agreements: Contracts as well as agreements are necessary, since a customer might need to bargain and also change these contracts to complete a purchase.

3. HAVE An ADVERTISING STRATEGY

If you’re expanding sales as well as profits, you have an efficient process for getting attention, creating interest, as well as an approach that distinguishes your product from the competition.

Your marketing strategy is a beneficial source to a customer, as well as your strategy allows the purchaser to drive sales and also earnings moving on. A buyer will certainly intend to see your ongoing plans to raise brand understanding and also a method that separates your product or services psychological of customers and potential customers. Discuss your system for generating leads and driving sales, and the future growth possibilities in market segments and also geographically.

4. HIRE A BUSINESS BROKER

If you’re telling yourself: “I require to market my service quick”, it’s seriously vital to locate a seasoned organization broker that can direct you via the process. When you’re trying to find an organization broker, you need to take into consideration these bottom lines:

Discover a certified company broker: The rate you inevitably receive for your company is affected by your certain industry and also various other aspects, such as basic economic problems. You need a skilled broker who will take these elements right into account and also compute a practical cost for your organization.

Get a current evaluation: A broker can aid you get a current evaluation for your company, and she or he can clarify the elements that are utilized to create the valuation.

Develop an advertising plan: Service brokers include remarkable worth by establishing an advertising and marketing plan to offer your organization. Get Tysdal’s on Instagram The broker can create written materials to promote your company and also determine prospects that will certainly understand the worth of your company.

Identify the vendor’s factors for leaving as well as life after the sale: Marketing your service is both an economic and also a personal decision and a broker can help you browse the personal side of a business sale. Prospective purchasers will need to know why you’re offering the business, as well as your broker can aid you address that concern.

5. PLAN TO TARGET CUSTOMER LEADS

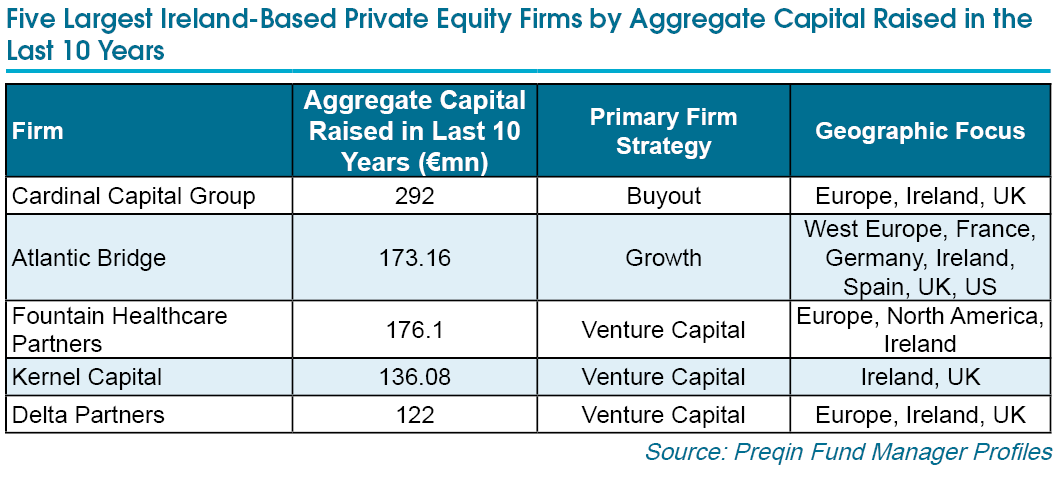

An organization customer might be a retired exec that wants to buy a company, a service that operates as a rival, or a personal equity firm.

Each of these purchasers might have various reasons for getting your firm, and also organization brokers understand these potential customers and their inspirations.

A knowledgeable broker creates and carries out an official strategy to find potential purchasers. When a prospect reveals a rate of interest, the business broker can pre-screen buyers to figure out if they have a trustworthy funding source, as well as if the purchaser is a good suitable for the transaction. The procedure of matching business vendors with an interested customer is an intricate process, and a business broker can assist you relocate with the process in less time.